Fill in a Valid Oklahoma Bt 190 Template

The Oklahoma BT-190 form, officially known as the Annual Business Activity Tax Return, plays a crucial role for businesses operating in the state. Every entity that has been conducting business in Oklahoma for over a year must file this form to comply with state tax regulations. The form is designed to capture essential information, including the business's Federal Employer Identification Number (FEIN), name, and address, as well as the North American Industry Classification System (NAICS) code. It is important to note that the form is due by July 1, following the tax year in question. The BT-190 consists of several parts, each serving a specific purpose: Part 1 assesses the net revenue of the business, while Part 2 calculates the Business Activity Tax owed. For businesses that operate in multiple states, Part 3 helps determine the revenue allocated to Oklahoma. Additionally, Part 4 addresses excluded revenue, and Part 5 lists responsible parties associated with the business. Finally, Part 6 allows for the computation of consolidated or combined net revenue if applicable. Understanding the nuances of the BT-190 is essential for ensuring compliance and avoiding potential penalties.

Document Properties

| Fact Name | Details |

|---|---|

| Governing Law | The Oklahoma BT-190 form is governed by Title 68 of the Oklahoma Statutes, specifically Sections 1215 to 1228. |

| Filing Requirement | All entities doing business in Oklahoma for more than one year are required to file the BT-190 form annually. |

| Due Date | The BT-190 form for the tax year 2010 was due on July 1, 2011. |

| Multi-State Businesses | Part 3 of the form is specifically designed for businesses that operate in multiple states, allowing them to allocate or apportion revenue to Oklahoma. |

| Parts Overview | The form consists of several parts: Part 1 determines net revenue, Part 2 calculates the Business Activity Tax, and Part 4 addresses excluded revenue. |

| Tax Calculation | The Business Activity Tax is generally equal to the Franchise Tax due on July 1, 2010, with a minimum tax of $25 for certain entities. |

| Responsible Party | The form requires listing responsible parties, which may include officers, partners, or registered agents of the business. |

Common mistakes

-

Incomplete Information: Many individuals forget to provide all necessary details, such as the Federal Employer Identification Number (FEIN), business name, or address. This omission can lead to processing delays or rejection of the form.

-

Incorrect Revenue Reporting: Some people mistakenly include excluded revenue types, such as interest, dividends, or real estate rentals, in their total revenue. This error can result in inaccurate tax calculations and potential penalties.

-

Misunderstanding Multi-State Business Requirements: For businesses operating in multiple states, failing to correctly complete Part 3 can lead to improper allocation of revenue and expenses. It is crucial to understand whether your business is unitary or non-unitary and to follow the appropriate guidelines.

-

Neglecting to Sign the Form: Some filers forget to sign and date the form. A missing signature can invalidate the return, causing delays in processing and potential penalties.

-

Failing to Meet Deadlines: Individuals often overlook the due date for submitting the form. Submitting late can result in interest charges and penalties, which could have been avoided with timely filing.

Popular PDF Documents

Bonded Title Oklahoma - Carrier safety is paramount; ensure you have the necessary federal numbers before applying.

How Much Is Capital Gains Tax in Oklahoma - Report details for properties sold in Oklahoma on the 561NR.

The Arizona Homeschool Letter of Intent is a document that parents must submit to formally notify the state of their decision to homeschool their children. This form serves as an essential step in the homeschooling process, ensuring compliance with Arizona's educational regulations. By completing this letter, parents can access more information and resources at arizonapdfforms.com/homeschool-letter-of-intent/, taking an important step in establishing their homeschooling journey.

Unclaimed Money Okc - The responsibilities outlined in the form apply to all entities holding unclaimed property in Oklahoma.

Misconceptions

- Misconception 1: Only Oklahoma-based businesses need to file Form BT-190.

- Misconception 2: The Business Activity Tax applies only to corporations.

- Misconception 3: Businesses that operate in multiple states can ignore the Oklahoma tax requirements.

- Misconception 4: The form is only due once a year.

- Misconception 5: All types of revenue are included in the total revenue calculation.

- Misconception 6: Filing a consolidated return is optional for businesses with multiple entities.

In reality, any entity doing business in Oklahoma, regardless of its origin, is required to file this form if it has been operating in the state for more than one year.

This tax affects a variety of business entities, including partnerships, limited liability companies, and business trusts. All must complete and file Form BT-190.

Multi-state businesses must allocate or apportion their revenue and expenses to Oklahoma, as outlined in Part 3 of the form. Ignoring this can lead to penalties.

While the form is filed annually, any late payments incur interest and penalties. It’s crucial to be aware of deadlines to avoid additional costs.

Specific types of income, such as interest, dividends, and capital gains, are excluded from the total revenue. These must be reported separately in Part 4.

For businesses that qualify, filing a consolidated return can be beneficial. However, if electing to do so, Part 6 must be completed, making it a requirement rather than an option.

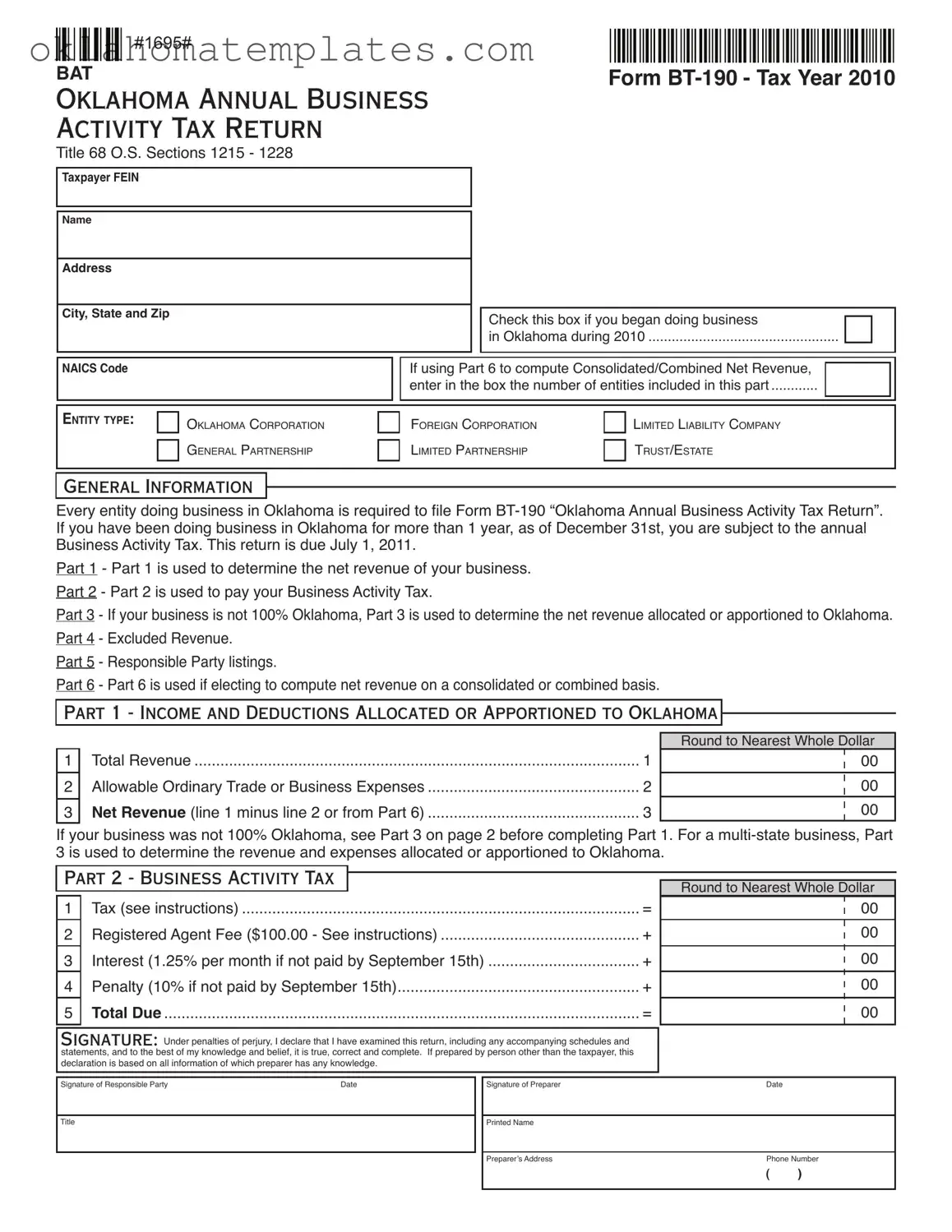

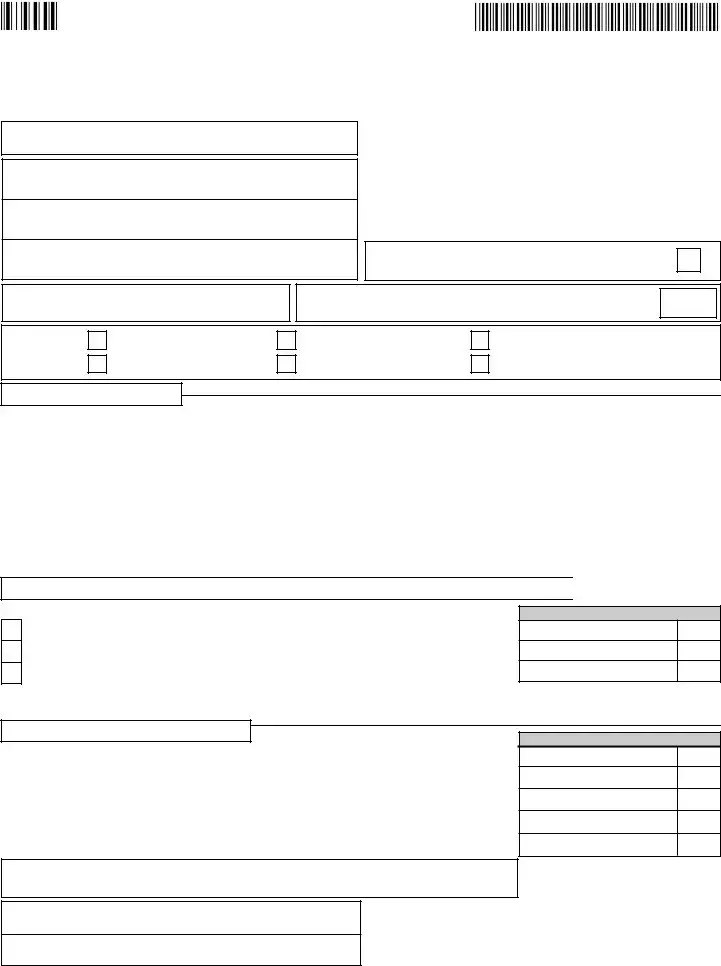

Preview - Oklahoma Bt 190 Form

#1695#

BAT

Oklahoma Annual Business Activity Tax Return

Title 68 O.S. Sections 1215 - 1228

Taxpayer FEIN

Name

Address

City, State and Zip

Form

Check this box if you began doing business

in Oklahoma during 2010 .................................................

NAICS Code

If using Part 6 to compute Consolidated/Combined Net Revenue,

enter in the box the number of entities included in this part ............

ENTITy TypE:

OklAhOmA CORPORATION

gENERAl PARTNERShIP

FOREIgN CORPORATION

lImITED PARTNERShIP

lImITED lIABIlITy COmPANy

TRUST/ESTATE

General Information

Every entity doing business in Oklahoma is required to ile Form

Part 1 - Part 1 is used to determine the net revenue of your business. Part 2 - Part 2 is used to pay your Business Activity Tax.

Part 3 - If your business is not 100% Oklahoma, Part 3 is used to determine the net revenue allocated or apportioned to Oklahoma. Part 4 - Excluded Revenue.

Part 5 - Responsible Party listings.

Part 6 - Part 6 is used if electing to compute net revenue on a consolidated or combined basis.

Part 1 - Income and Deductions Allocated or Apportioned to Oklahoma

1

2

3

Total Revenue |

1 |

Allowable Ordinary Trade or Business Expenses |

2 |

Net Revenue (line 1 minus line 2 or from Part 6) |

3 |

Round to Nearest Whole Dollar

00

00

00

If your business was not 100% Oklahoma, see Part 3 on page 2 before completing Part 1. For a

Part 2 - Business Activity Tax

1 |

Tax (see instructions) |

= |

2 |

Registered Agent Fee ($100.00 - See instructions) |

+ |

3 |

Interest (1.25% per month if not paid by September 15th) |

+ |

4 |

Penalty (10% if not paid by September 15th) |

+ |

5 |

Total Due |

= |

Round to Nearest Whole Dollar

00

00

00

00

00

Signature: Under penalties of perjury, I declare that I have examined this return, including any accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct and complete. If prepared by person other than the taxpayer, this declaration is based on all information of which preparer has any knowledge.

Signature of Responsible Party |

Date |

Title

Signature of Preparer |

Date |

|

|

|

|

Printed Name |

|

|

|

|

|

Preparer’s Address |

Phone Number |

|

|

( |

) |

|

|

|

#1695#

#1695#

Form |

OKLAHOMA ANNUAL BUSINESS ACTIVITY TAX RETURN |

|

Title 68 O.S. Sections 1215 - 1228 |

Taxpayer Name:

Taxpayer FEIN:

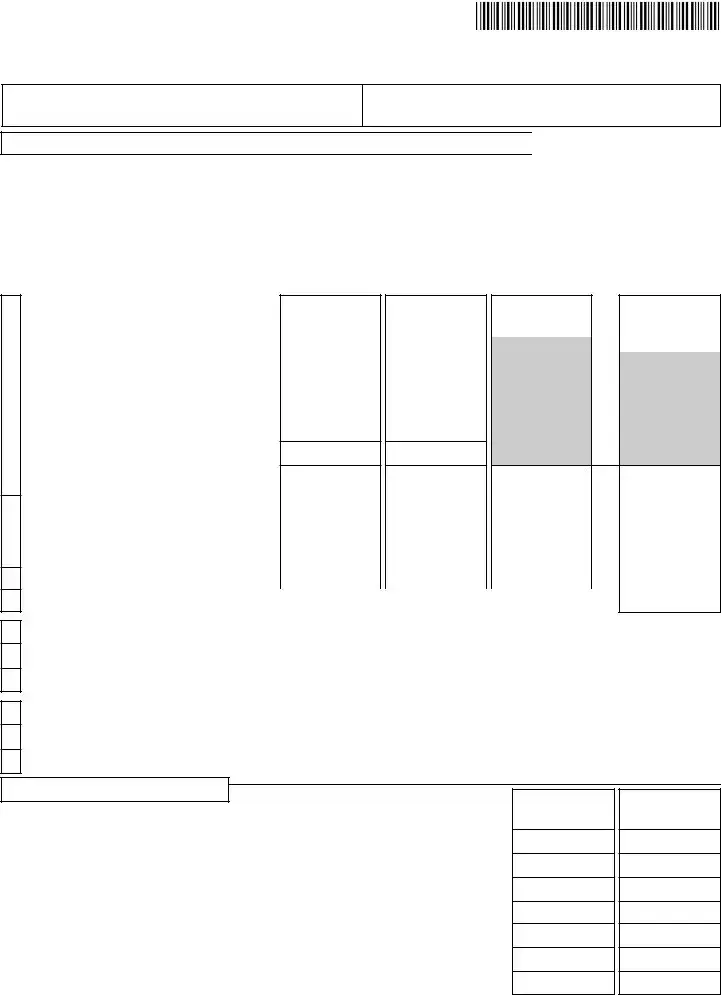

PART 3 -

Complete the appropriate Section, A or B, applicable to your

SECTION A: A

(you must enclose a schedule showing your computations)

Indicate the method used to allocate expenses to Oklahoma: ___________________________________________

Indicate the method used to allocate expenses to Oklahoma: ___________________________________________

Or

SECTION B: A UNITARY BUSINESS (APPORTIONABLE INCOME) - Apportionment Formula Worksheet

1

2

3

4

5

6

7

8

9

10

Value of real and tangible personal property used in |

Column A |

|

Column B |

|

Column C |

Column D |

||

the unitary business (by averaging the value at the |

Total Within |

|

Total Within and |

|

A divided by B |

Apportioned to |

||

beginning and ending of the tax period). |

|

Oklahoma |

|

Without Oklahoma |

% |

|

Oklahoma |

|

(a) Owned property (at original cost): |

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

(I) Inventories |

1aI |

|

|

|

|

|

|

|

(II) Depreciable property |

1aII |

|

|

|

|

|

|

|

(III) land |

1aIII |

|

|

|

|

|

|

|

(IV) Total of section “a” |

1aIV |

|

|

|

|

|

|

|

(b)Rented property (capitalize at 8 times net rental paid) .1b

(c) Total of sections “a” and “b” above |

1c |

|

X10% |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) Payroll |

2a |

|

|

|

|

|

|

|||||

(b) Less: Oficer salaries |

|

|

|

|

|

|

|

|

|

|

|

|

2b |

|

|

|

|

|

|

|

|

|

|

|

|

......(c) Total (subtract oficer salaries from payroll) |

2c |

|

X10% |

|||||||||

Total Revenue |

3 |

|

|

|

|

|

|

|

X80% |

|||

|

|

|

|

|

|

|

|

|

|

|

||

Apportionment Factor (sum of percentages in Column D) |

|

4 |

|

|

||||||||

Total Revenue (from line 3, Column B above) |

5 |

($) |

|

|

||||||||

|

|

|||||||||||

|

|

|||||||||||

Apportioned Factor (percentage from line 4 above) |

6 |

(%) |

|

|

||||||||

|

|

|||||||||||

Total Revenue apportioned to Oklahoma (multiply line 5 by line 6; enter here and on Part 1, line 1) |

.........7 |

($) |

|

|

||||||||

Total allowable ordinary trade or business expense(s) |

8 |

($) |

|

|

||||||||

|

|

|||||||||||

|

|

|||||||||||

Apportionment Factor (percentage from line 4 above) |

9 |

(%) |

|

|

||||||||

..............Expenses apportioned to Oklahoma (multiply line 8 by line 9; enter here and on Part 1, line 2) |

($) |

|

|

|||||||||

PART 4 - EXCLUDED REVENUE:

If iling consolidated/combined (Part 6), complete Part 4 for each entity, as applicable.

1 |

Interest |

1 |

2 |

Dividends and Distributions |

2 |

3 |

Real Estate Rentals |

3 |

4 |

mineral Rights |

4 |

5 |

Net Capital gains |

5 |

6 |

Compensation |

6 |

7 |

Total Amount of Revenue excluded from Part 1, line 1 “Total Revenue” |

7 |

Column A

Total Within and

Without Oklahoma

Column B

Apportioned to

Oklahoma

#1695#

#1695#

Form |

OKLAHOMA ANNUAL BUSINESS ACTIVITY TAX RETURN |

|

Title 68 O.S. Sections 1215 - 1228 |

Taxpayer Name:

Taxpayer FEIN:

Part 5 - Responsible Party Listings

If iling consolidated/combined (Part 6), complete Part 5 for each entity, as applicable.

Responsible Party Information

Enter the Responsible Party. Responsible parties are oficers, members, partners or registered agents as may be applicable as of the last day of the calendar year.

Name (irst name, middle initial, last name) or Entity Name |

Social Security Number/FEIN |

|

|

home Address (street and number) |

Daytime Phone (area code and number) |

|

|

City, State, Zip |

Title |

|

|

|

|

Name (irst name, middle initial, last name) or Entity Name |

Social Security Number/FEIN |

|

|

home Address (street and number) |

Daytime Phone (area code and number) |

|

|

City, State, Zip |

Title |

|

|

|

|

Name (irst name, middle initial, last name) or Entity Name |

Social Security Number/FEIN |

|

|

home Address (street and number) |

Daytime Phone (area code and number) |

|

|

City, State, Zip |

Title |

|

|

|

|

Name (irst name, middle initial, last name) or Entity Name |

Social Security Number/FEIN |

|

|

home Address (street and number) |

Daytime Phone (area code and number) |

|

|

City, State, Zip |

Title |

|

|

#1695#

#1695#

Form |

OKLAHOMA ANNUAL BUSINESS ACTIVITY TAX RETURN |

|

Title 68 O.S. Sections 1215 - 1228 |

Taxpayer Name:

Taxpayer FEIN:

Part 6 - Computation of Oklahoma Consolidated/Combined Net Revenue - Part 1, line 3

COMPUTE NET REVENUE:

Name of Corporations Included |

Federal |

NAICS |

Total |

Allowable |

Oklahoma |

in the Consolidated/Combined |

Id |

Code |

Revenue |

Ordinary Trade |

Net |

Return (If more space is needed attach a |

Number |

|

|

or Business |

Revenue |

supplemental schedule) |

|

|

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total from Supplemental Schedule |

|

|

|

|

Total Revenue (1), Total Allowable Ordinary Trade or |

|

|

|

|

|

|

|

||

1) |

2) |

3) |

||

Business Expenses (2) and Total Oklahoma Net |

||||

|

|

|

||

Revenue (3) (Enter here and on the applicable lines in Part 1). |

|

|

|

OKLAHOMA ANNUAL BUSINESS ACTIVITY TAX RETURN

Instructions

All entities doing business in Oklahoma for more than one year are subject to the Business Activity Tax. All Corporations,

limited liability Companies and Partnerships, regardless of length of time doing business in Oklahoma, must complete and ile Form

The North American Industry Classiication System (NAICS) Code is the six digit code on your federal income tax return.

PART 1 - INCOME AND DEDUCTION ALLOCATED OR APPORTIONED TO OKLAHOMA:

For some business entities all of the business is in Oklahoma. If your business is conducted both within and without Oklahoma, refer to Part 3 to compute income and deductions.

(Instructions continued on page 5)

Form

OKLAHOMA ANNUAL BUSINESS ACTIVITY TAX RETURN

Instructions

PART 1 - INCOME AND DEDUCTION ALLOCATED OR APPORTIONED TO OKLAHOMA (CONTINUED)

line 1 - Total Revenue:

Enter the gross income from your last iled Federal income tax return. Do not include the following in Total Revenue:

1.interest, except interest from credit sales,

2.dividends and distributions received from corporations, and distributive or proportionate shares of total receipts and other income from a

Statutes,

3.real estate rentals,

4.royalty interests or working interests in mineral rights,

5.net capital gains, as deined in Section 1222(11) of the Internal Revenue Code, included in the federal income tax return of a person, and

6.compensation, whether current or deferred, and whether in cash or in kind, received or to be received by an employee, former employee, or the employee’s legal successor for services rendered to or for an employer, including reimbursements received by or for an individual for medical or education expenses, health insurance premiums, or employee expenses, or on account of a dependent care spending account, legal services plan, any cafeteria plan described in section 125 of the Internal Revenue Code, or any similar employee reimbursement.

The above items of excluded revenue must be reported in Part 4 – Excluded Revenue.

line 2 - Allowable Ordinary Trade or Business Expenses:

Enter all of the entity’s ordinary trade or business expenses including cost of goods sold. Do not include interest expense, income taxes, depreciation or amortization. Also, do not include any expenses attributable to

NOTE: If you are iling a consolidated/combined Business Activity Tax Return, Part 6 must be completed before Part 1.

PART 2 - BUSINESS ACTIVITY TAX:

line 1 - Tax:

For most entities iling this form, the Business Activity Tax is equal to the Franchise Tax that was due and payable July 1, 2010. Entities not subject to Franchise tax have a Business Activity Tax of $25. These entities include limited liability Companies, general Partnerships, limited Partnerships and Business Trusts.

line 2 - Registered Agent Fee:

When submitting the Business Activity Tax Return, foreign corporations must pay a $100 registered agent fee.

line 3 - Interest:

If this return is postmarked after September 15th, the tax is subject to 1.25% interest per month from the due date until it is paid. multiply the amount in Part 2, line 1 by .0125 for each month the report is late.

line 4 - Penalty:

If this return is postmarked after September 15th, the tax is subject to a penalty of 10%. multiply the amount in Part 2, line 1 by .10 to determine the penalty.

PART 3 -

(If iling consolidated/combined [Part 6], complete Section A or B for each entity, as applicable.)

Section A - A

If your business was conducted both within and without Oklahoma of a

the total direct expense everywhere. Indicate the method used to allocate expenses to Oklahoma and enclose a schedule of computations showing the computation for the revenue and expenses entered in Part 1 “Income and Deductions Allocated or Apportioned to Oklahoma”.

Section B - A Unitary Business (Apportionable income):

If your business was conducted both within and without Oklahoma of a unitary character complete Part 1 by entering the

revenue and expenses apportioned to Oklahoma. To determine the revenue and expenses apportioned to Oklahoma, per 68 O.S. Section 1226, irst complete the Apportionment Formula Worksheet to determine the apportionment factor. The apportionment factor will be multiplied by the total revenue and total expenses everywhere to determine the revenue and expenses to enter in Part 1 “Income and Deductions Allocated or Apportioned to Oklahoma”.

Form

OKLAHOMA ANNUAL BUSINESS ACTIVITY TAX RETURN

Instructions

PART 3 -

lines 1 and 2:

The Property and Payroll factors are determined as provided for in Title 68 O.S. Section 2358.

•Column A - Total Revenue within Oklahoma is your total revenue from activities performed in Oklahoma. See the instructions for Part 1, line 1 to determine “Total Revenue”.

•Column B - Total Revenue within and without Oklahoma is your total revenue from activities performed everywhere. See the instructions for Part 1, line 1 to determine “Total Revenue”.

line 8:

Enter the allowable ordinary trade or business expenses from your business activity both within and without Oklahoma. See the instructions for Part 1, line 2 to determine “allowable ordinary trade or business expenses”.

PART 4 - EXCLUDED REVENUE INSTRUCTIONS:

(If iling consolidated/combined [Part 6], complete Part 4 for each entity, as applicable.)

List separately each item of revenue not included in Part 1 “Total Revenue”. A list of excludable revenue is found in the

instructions for Part 1, line 1.

•If your business was 100% Oklahoma, enter the same amount in both columns.

•If your business was not 100% Oklahoma, enter the total amount of excludable revenue from your operations ev- erywhere in Column A. multiply the amount reported in Column A by the apportionment factor from Part 3, line 4 and enter the result in the Oklahoma column (Column B).

PART 5 - RESPONSIBLE PARTY INSTRUCTIONS:

(If iling consolidated/combined [Part 6], complete Part 5 for each entity, as applicable.)

•Corporations (Both C and Subchapter S) - Enter the current oficers effective as of December 31, 2010. Include name, title, address, phone number and Social Security Numbers/FEINs. Oficers include, but are not limited to, president, vice president, secretary and treasurer. list registered agent if applicable.

•limited liability Companies - Enter all current members of the limited liability Company effective as of December 31, 2010. Include name, title, address, phone number and Social Security Numbers/FEINs.

•Partnerships - Enter all current partners of the Partnership effective as of December 31, 2010. Include name, title, ad- dress, phone number and Social Security Numbers/FEINs.

•Business Trusts - Enter all current trustees and beneiciaries of the trust effective as of December 31, 2010. Include name, title, address, phone number and Social Security Numbers/FEINs.

please include Social Security Numbers of Responsible parties.

If

All returns, applications, and forms required to be iled with the Oklahoma Tax Commission (Commission) in the adminis- tration of this State’s tax laws shall bear the Federal Employer’s Identiication Number(s) or the Social Security Ac- count Number (or both) of the person, irm, or corporation iling the item and of all persons required by law or agency rule to be named or listed. If more than one number has been issued to the person, irm, or corporation, then all numbers will be required. [Source: Amended at 16 Ok Reg 2628, eff

All Federal Employer’s Identiication and/or Social Security Account Numbers are deemed to be included in the coniden-

tial records of the Commission.

If more space is needed attach a schedule.

This return must be iled by July 1, 2011.

Mail completed Form

Oklahoma Tax Commission

Post Ofice Box 26930

Oklahoma City, OK

FAQ

What is the Oklahoma BT-190 form?

The Oklahoma BT-190 form is the "Oklahoma Annual Business Activity Tax Return." Every entity doing business in Oklahoma for more than one year must complete and file this form. It is essential for determining the net revenue of your business and calculating the associated Business Activity Tax. The form includes various parts that help you report your total revenue, allowable expenses, and any revenue that may be excluded from the tax calculation.

Who needs to file the BT-190 form?

Any business entity that has been operating in Oklahoma for over a year is required to file the BT-190 form. This includes corporations, limited liability companies, partnerships, and business trusts. Even if your business is not solely based in Oklahoma, you still need to file if you have any revenue generated within the state. If you started your business in Oklahoma during the tax year, you would need to check the corresponding box on the form.

What are the main parts of the BT-190 form?

The BT-190 form consists of several parts. Part 1 is used to determine your business's net revenue by reporting total revenue and allowable expenses. Part 2 calculates the Business Activity Tax owed. If your business operates in multiple states, Part 3 helps allocate or apportion revenue to Oklahoma. Part 4 addresses any excluded revenue, while Part 5 lists responsible parties associated with the business. Lastly, Part 6 is for those who wish to compute net revenue on a consolidated or combined basis.

What happens if I miss the filing deadline?

The filing deadline for the BT-190 form is July 1 of the following year after the tax year. If you miss this deadline, your tax may incur interest and penalties. Specifically, a 1.25% interest charge per month applies if the return is postmarked after September 15. Additionally, a penalty of 10% may be added to the amount due. It’s crucial to file on time to avoid these extra costs.

How do I determine the revenue to report on the BT-190 form?

Documents used along the form

When filing the Oklahoma BT-190 form, there are several other documents that are often needed to ensure compliance with state regulations. Each of these forms serves a specific purpose in the overall process of reporting business activity and tax obligations. Below is a list of these documents, along with a brief description of their significance.

- Form 511: This is the Oklahoma Individual Income Tax Return. If the business is a pass-through entity, the income may flow through to the owners, who must report it on their personal tax returns using this form.

- Quitclaim Deed: This form is particularly important for transferring property ownership without ensuring the title’s legitimacy. It is often used in family transactions or to resolve title disputes. More information can be found at UsaLawDocs.com.

- Form 1000: This is the Oklahoma Corporate Income Tax Return. Corporations must file this form to report their income and calculate the corporate tax owed to the state.

- Form 300: This is the Oklahoma Franchise Tax Return. It is required for certain entities, like corporations and limited liability companies, to report their franchise tax obligations in Oklahoma.

- Form 1099: Used to report various types of income other than wages, salaries, and tips. Businesses may need to issue this form to contractors or vendors who have been paid during the tax year.

- Form W-2: Employers use this form to report wages paid to employees and the taxes withheld from those wages. It’s essential for employees when filing their personal income tax returns.

- Form 1095-B: This form is used to report health coverage information. It is necessary for businesses that provide health insurance to their employees, ensuring compliance with the Affordable Care Act.

- Form 941: This is the Employer's Quarterly Federal Tax Return. Businesses must file this form to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks.

- Form ST-3: This is the Oklahoma Sales Tax Exemption Certificate. Businesses may need this form to claim an exemption from sales tax on certain purchases made for business operations.

- Form BT-190 Instructions: While not a form per se, the instructions provide detailed guidance on how to correctly fill out the BT-190 form, including information on what to include and how to calculate tax liabilities.

Having these documents ready can streamline the filing process and help avoid potential issues with tax compliance. Each form plays a critical role in ensuring that businesses meet their obligations and maintain good standing with the state of Oklahoma.

Guide to Using Oklahoma Bt 190

Filling out the Oklahoma BT-190 form is a necessary step for any business operating in the state for more than one year. This form collects essential information regarding your business's revenue and tax obligations. Completing it accurately ensures compliance with state regulations and helps avoid potential penalties.

- Gather necessary information: Collect your business's Federal Employer Identification Number (FEIN), total revenue, allowable expenses, and other financial data from your previous tax returns.

- Identify your business type: Check the appropriate box for your entity type, such as Oklahoma Corporation, Foreign Corporation, or Limited Liability Company.

- Complete Part 1: Enter your total revenue on line 1, subtract allowable ordinary trade or business expenses on line 2, and calculate your net revenue on line 3.

- Fill out Part 2: Calculate your Business Activity Tax, including any registered agent fees, interest for late payments, and penalties if applicable. Sum these amounts to determine your total due.

- If applicable, complete Part 3: For businesses not 100% in Oklahoma, choose between Section A (Non-Unitary Business) or Section B (Unitary Business) to allocate or apportion revenue and expenses correctly.

- Move to Part 4: List any excluded revenue that should not be included in your total revenue calculation.

- Complete Part 5: Provide details for responsible parties, including names, titles, and contact information for individuals or entities responsible for the business.

- If filing on a consolidated or combined basis, fill out Part 6: Compute net revenue for each corporation included in the consolidated return.

- Sign and date the form: Ensure that the responsible party and preparer (if applicable) sign and date the form to certify its accuracy.

- Submit the form: Mail the completed form to the appropriate address provided in the instructions, ensuring it is postmarked by the due date to avoid penalties.