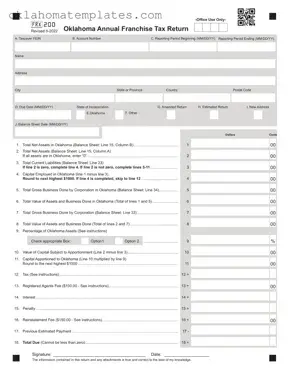

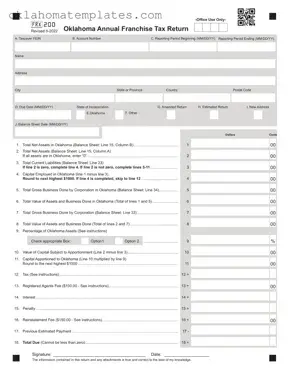

The Oklahoma 200 form is the Annual Franchise Tax Return required for corporations doing business in Oklahoma. This form helps the state assess the franchise tax based on the corporation's assets and business activities within the state. If you need...

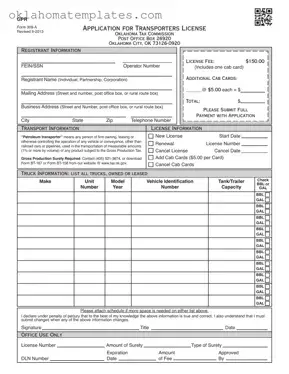

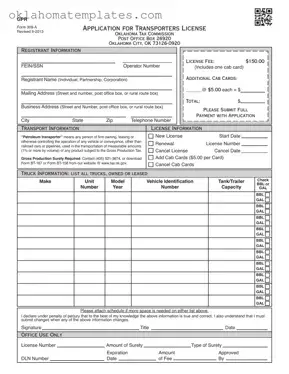

The Oklahoma 309A form is an application for a transporter’s license, specifically designed for individuals or businesses involved in the transportation of petroleum products. This form requires registrant information, transport details, and payment of a license fee. To begin the...

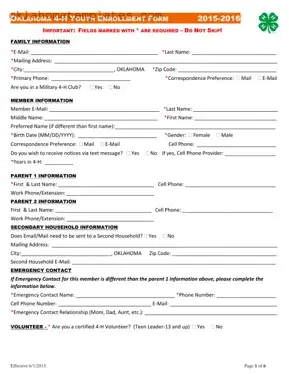

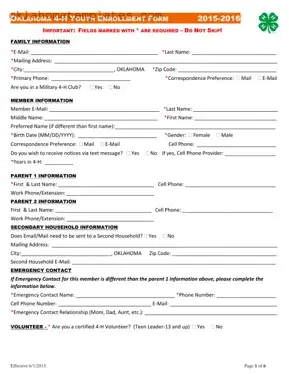

The Oklahoma 4-H Youth Enrollment Form is a vital document that facilitates the registration of youth participants in the 4-H program across Oklahoma. This form collects essential information about both the youth and their families, ensuring that all necessary details...

The Oklahoma 501 form is an annual information return required by the Oklahoma Tax Commission. This form helps report various payments made throughout the year, ensuring compliance with state tax laws. If you need to fill out the Oklahoma 501...

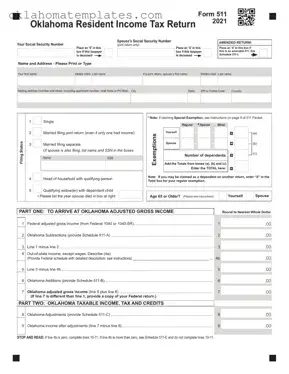

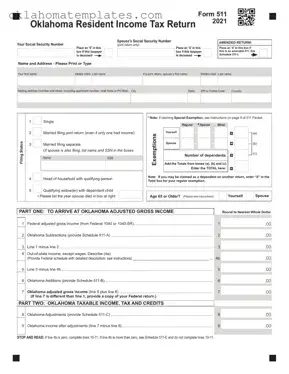

The Oklahoma 511 form is the Resident Income Tax Return used by individuals to report their income and calculate their tax obligations in the state of Oklahoma. This form collects essential information such as Social Security numbers, filing status, and...

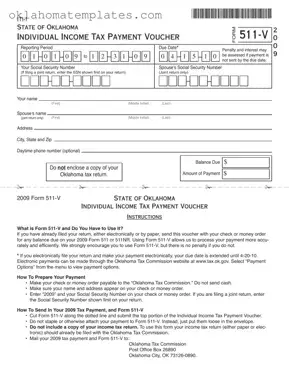

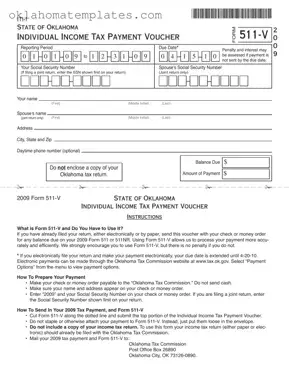

The Oklahoma 511 V form is an Individual Income Tax Payment Voucher designed for taxpayers who need to submit a payment for any balance due after filing their tax returns. By using this form, individuals can ensure their payments are...

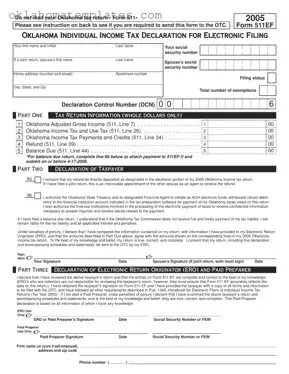

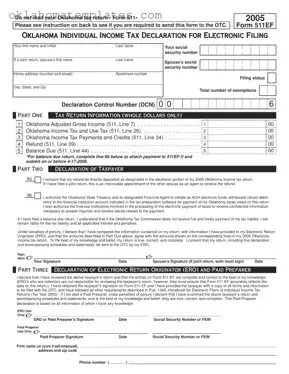

The Oklahoma 511EF form serves as the declaration for individuals filing their income tax returns electronically in Oklahoma. This form is essential for ensuring that taxpayers accurately report their income and tax obligations while facilitating a streamlined electronic filing process....

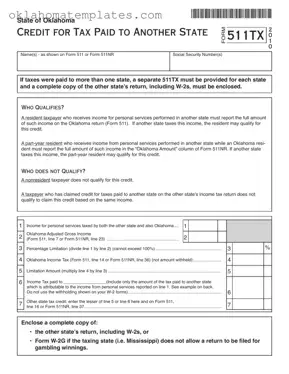

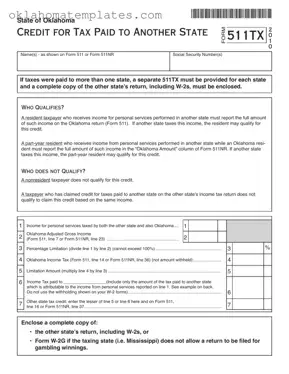

The Oklahoma 511Tx form is a tax document used by Oklahoma residents and part-year residents to claim a credit for taxes paid to another state on income earned from personal services. This form is essential for individuals who have been...

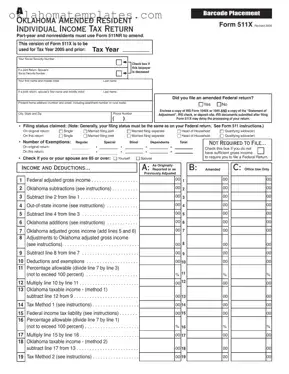

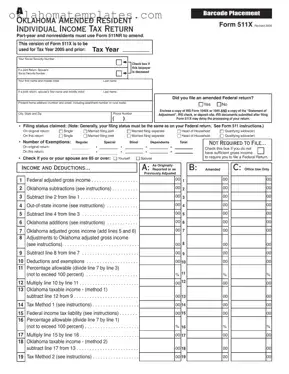

The Oklahoma 511X form is an amended resident individual income tax return designed for Oklahoma residents who need to correct their tax filings for Tax Year 2005 and earlier. This form allows taxpayers to make necessary adjustments, ensuring that their...

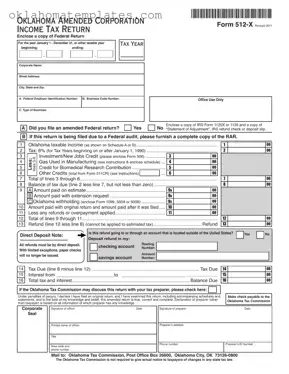

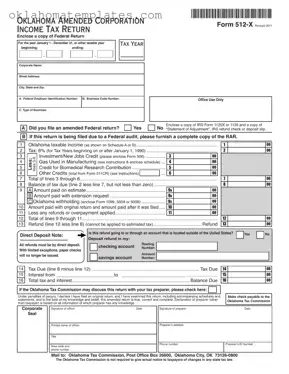

The Oklahoma 512 X form is the Amended Corporation Income Tax Return used by businesses to correct previously filed tax returns. This form allows corporations to adjust their taxable income and claim any credits or deductions they may have missed....

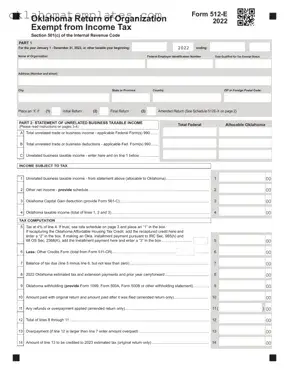

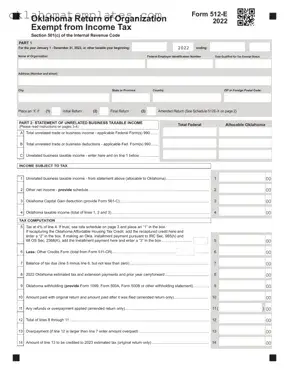

The Oklahoma Return of Organization Exempt from Income Tax Form 512E is a crucial document for organizations seeking to maintain their tax-exempt status under Section 501(c) of the Internal Revenue Code. This form is used to report unrelated business income...

The Oklahoma 538 S form is a document used by residents of Oklahoma to claim a credit or refund for sales tax paid. Specifically designed for individuals with a household income of $12,000 or less, this form allows eligible applicants...